After a bittersweet graduation and an extensive job search, budgeting may be the last thing on your mind. But despite what your college lifestyle may have led you to believe, the dance floor is not the last place you’ll be hearing about dolla dolla bills — in fact, you’re more responsible for your finances now than ever. Your post-college expenditures won’t just consist of late-night library vending machine raids and beach week martinis, but also rent, utilities, insurance, and, well, everything else. It may sound scary, but have no fear — Her Campus has tips on how to create and perfect your very own post-collegiette budget.

Image may be NSFW.

Clik here to view.

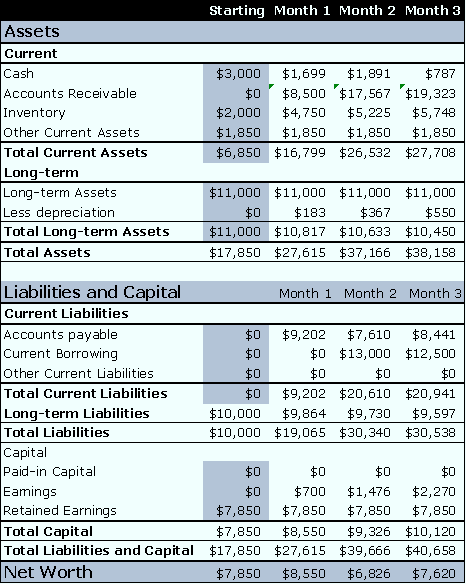

Count your money. The first step to creating a budget for the future is to evaluate your current financial standing. First, figure out how much you have and if you’re in any debt at this instant by calling or checking online to view the numbers in your checking and savings accounts, and pulling out loan statements and deadlines. Then factor in how much money you’re bringing in, which means combining your salary with the money you receive from any part-time jobs, internship stipends, tips, and any other supplementary income. “It is vitally important to take a holistic view of both your personal ‘balance sheet’ [a spreadsheet of] assets and liabilities, otherwise known as ‘what you own and what you owe,’ as well as your personal income statement — income and expenses — when creating a budget,” says Chris Bumcrot, a financial researcher and a partner at Applied Research & Consulting in New York City. Bumcrot credits the importance of being conscious of your financial standing to avoiding debt, but it’s essential to structuring your budget, too — even if you’re in the clear!

Do your homework. As independent and free-spirited as you thought you were at 18, Mom and Dad still took the brunt of worrying about expenses. And while you can easily calculate your savings and spending, it’s impossible to know how much certain necessities cost without asking around or looking it up. Once you move in to your apartment, your bills will show you how much you’re spending, but there are a few things you can do between graduation and move-in day to make sure you’re in for no surprises: call up your utility companies — the guys who supply stuff like your water and electricity (they don’t arrive by magic) — and the landlord of your apartment complex. If you’re using a broker to find your new apartment — someone who helps with the apartment in exchange for a certain cut of a year’s rent — find out what percent he or she charges and calculate your expenses based on your rent. Even if you’ve been moved in for a while, be smart about the way you estimate your costs. Look over credit card statements from previous months and calculate the average amount you spend on an item monthly. Factor in important details, like how much of your salary is eaten up by taxes each month, so that your estimates are as accurate as possible.

Don’t just research your costs — read up on ways you can pay them, too. Consult your parents to figure out just how much they are willing to support you, if at all. Search for alternative ways of paying off significant costs like student loans. “One of the things that the federal government has done is offered different options for paying student loans; they recognize that students have bills to pay and may be in transition,” says Craig Daugherty, director of financial aid at Kenyon College. “There are certainly some loan repayment options: if you go to graduate school, for example, or if you serve in the military. My advice to any student would be to stay in contact with your lender and to see what options may be available.”

Image may be NSFW.

Clik here to view.

Use a toolkit. The web is full of budgeting instruments that are enormously helpful in tracking your financial standing and compiling information about your savings, checking, investments, car, and living expenses into one online account. Mint.com, for instance, has gained incredible popularity for a reason: among other features, Mint allows you to determine your “net worth” by calculating all your assets and liabilities in one place, categorize your expenses, create micro-budgets within those categories, and know when you’re approaching a budget limit or deadline through reminders, alerts and color-coded bar graphs. LearnVest.com is another fantastic online budgeting resource; founded by a Harvard Business School dropout, LearnVest connects its members with financial experts who assist in developing a budget as well as a long-term plan. The site also publishes tons of useful articles and tips on how to budget and save effectively. Other budgeting sites that include similar features include Buxfer.com and moneyStrands.

Not ready to take the dive into a membership, but still looking for information? Bumcrot recommends checking out other public resources like FeedThePig.org, provided by American Institute of Certified Public Accountants (AICPA), and SaveAndInvest.org— Provided by Financial Industry Regulatory Advisory (FINRA) Investor Education Foundation, both of which provide helpful information, quick tips for financial stability, and savings calculators. Other informative sites include CNN Money’s Debt Reduction Planner, NetQuote.com for free insurance quotes, and BankRate.com to look up bank, mortage, auto loan, insurance, tax, and other rates.

Fill in the blanks. Now that you’ve gathered enough information about your expenses, list them on the “what you owe” side of your balance sheet. Don’t forget to consider the costs of starting out on your own. Sites like the ones listed above not only help you organize your budget, but also add items to it that you previously overlooked. Daugherty sees many recent graduates who fail to factor in invisible costs: “When you start a professional career, there are several start-up costs,” he says. “In an office setting, for instance, you need to update your wardrobe — a few new suits, for instance.” Bumcrot agrees that many young adults should be thorough with their budgeting: “The most commonly overlooked expenses by young graduates when budgeting are insurance and taxes,” he adds. “Make sure you account for health insurance, auto insurance, federal and state/local income taxes, Social Security tax, and Medicare tax. Some of these will be taken out of your paycheck automatically, but you still must account for them in your budget.” Here are some of the most common costs for recent grads:

- Rent + broker’s fee

- Utilities (air conditioning, heat, hot water, gas, electric)

- Transportation (parking, gas, public transportation passes, maintenance fees)

- Food (groceries, meals out)

- New clothes (for moving to a new climate or professional setting)

- New furniture (bed frames, couches, TV stand, drawer sets, dining table, chairs)

- Electronics (TV, cable or satellite, Internet, music, cell phone and landline plans)

- Student loans (federal and private)

- Memberships and subscriptions (gym memberships or classes, magazines, newspapers)

- Medical expenses (prescriptions, over-the-counter medications)

- Insurance (auto, health, dental, property)

- Taxes (local, state, federal)

Cut down. If your budget isn’t looking as swanky as you’d like it to, look for ways to trim costs, even if it means sacrificing some freedom right now. Take Liz Refsnyder, for example. She graduated from Kenyon College in 2010 and now works as a paralegal in Baltimore, Maryland, but not before getting a master’s degree close to home to save up: “I lived at home and worked part-time while going to school to avoid taking out anymore student loans. This turned out to be beneficial in the long run because I was able to save money and travel before going out on my own.” Your parents can help in ways other than giving you a place to crash, too. Under the Affordable Care Act, for example, you can be eligible for your parents’ health insurance plan until the age of 26. The philosopher Plato once said, “Let parents bequeath to their children not riches, but the spirit of reverence,” but hey, why not both?

Remember that Mint.com and LearnVest.com also have newsletters and helpful tips sent to their members daily, so take advantage of that information if you’re looking for creative new ways to trim your budget.

Image may be NSFW.

Clik here to view.

Leave some wiggle room. Remember when you kept a stash of chocolate bars in your dorm room in case of a bitter break-up or painful all-nighter? Put that kind of thinking to use and create a similar fund for financial emergencies. “It’s a great idea to establish a rainy day fund if you have any extra money at the end of the pay period [the amount of time between each paycheck],” says Daugherty. “It’s tempting to use the remaining amount of money for leisure, but for instance, if you’re experiencing a severe heat wave in the summer, air conditioning bills can climb in the summer. In the winter, the heating bills can do the same. It’s good to have a cushion so that you can prepare for those types of situations.” Liz remembers to save by refraining from spending her bonuses: “I overestimate monthly expenses and do not depend upon any salary bonuses for safe measure,” says Liz. “Saving a small amount of money for unforeseen expenses, like emergency travel or car care, will help you stay within your means.”

Save! Also set aside a portion of your income for — gasp — the future. You are probably only responsible for yourself right now, but at some point you’ll probably be buying a mortgage, supporting children, and eventually retiring, all of which require serious financial preparation. “Consider putting money away for a retirement account, especially if your employer is willing to match what you put in,” says Daugherty. “It’s hard for young people to talk about retirement, but contributing even a little bit of money in your 20s can amount to a lot in your 60s or 70s.” Liz agrees: “I would highly recommend that new grads participate in employer 401k programs,” she says. “Planning for retirement might sound strange to a 21-year-old, but these programs allow employees to divert a certain percentage of their earning into a retirement fund. Employers will often match employee contributions up to certain percentage, which means free money to help pay off student loans.”

“The bottom line is to allocate at least some of your income to savings in a systematic way,” says Bumcrot. Your budgeting toolkit can help with this, but beyond tracking your expenses, try to establish money-saving habits that can have serious long-term benefits and build you savings for the future. Bumcrot suggests, “one trick is to take any windfalls you receive (e.g., cash gifts from parents and grandparents, bonuses from work, inheritances) and put them into savings.”

Image may be NSFW.

Clik here to view.

Track your spending and stick to your budget. Lists and spreadsheets can help you organize your thoughts, but only determination and willpower can actually keep you from exceeding your budget. So exercise self-control and resist the impulse to make it rain like Lil’ Wayne after every paycheck (or if you can’t, be sure to pick up the cash when you’re done and invest it somewhere useful). Sticking to a budget on your own is a challenge at first and you may feel inexperienced, but learning to channel your undergrad experiences into this one can help: “Having a job [in college] and my parents encouraging me to pay for certain things with my own money helped me learn budgeting — when I could spend money and when I should save it,” says Sharmila Kulkarni, a graduate of Michigan State University and a third year medical school student at the University of Toledo College of Medicine.

“Before accepting my position [as a paralegal], I created a budget for myself to ensure that my expenses would not exceed my earnings,” says Liz. Like many of her peers, she uses Mint.com. Put your own Mint.com or LearnVest.com registration to use, and check out other sites specifically designed for controlling your urge to splurge and save money for what really matters. Since most purchases are made away from home or on the go, though, we tracked down the app for Mint, plus a few more of the best budgeting apps for your phone — all of which are totally free:

- iSlick— Consolidates coupons from sites like Amazon and Groupon and notifies you of them in real time so that you can stay up-to-date on all your deals and steals by checking just one source.

- PageOnce— Allows you to not only track your spending, but also to pay your bills from your iPhone or iPad and to receive reminders and alerts of upcoming due dates and suspicious transactions.

- PocketMoney LITE— Includes a set of money-tracking features, plus tools like budget limits and auto-complete to speed up transactions. One of PocketMoney’s coolest functions is its ability to process international currency and its ability in more than 15 languages — perfect for budgeting your adventures and purchases while studying abroad

If you opt not to rely on the web for your finances, though, be sure to keep track of them in some other way, no matter how silly you feel recording how much you spent on fruit snacks at the grocery store. Despite what the items on your receipt might suggest, remember that you are a responsible adult.

Image may be NSFW.

Clik here to view.

Pay your bills on time. Whether you keep track of your bills on paper or online, make sure you’re well aware of upcoming deadlines — and how important it is that you meet them. “Make sure that you are paying down any high-interest debt you have as quickly as possible,” says Bumcrot. “It is equally important to be sure that you never fall behind on any of your debt payments, whether low-interest or high-interest. The reason for this is that missed debt payments will adversely affect your credit rating, which will cause financial trouble for you in the years ahead.” Daugherty agrees that good credit should be a priority for every fiscally conscious college grad: “Establishing good credit is helpful for when you mature and want to purchase a car or a home, or support a family,” he says. “What you do now can definitely affect the interest rates you’ll experience down the road.” Liz finds this principle most relevant to paying her credit card bills: “Grads should be forewarned that credit cards are your best friend or your worst enemy,” she says. “I pay my balance off in full every month to avoid paying ridiculous interest rates. If you have to carry a balance, pay it off as soon as possible!”

So you understand how important it is to be a punctual payer. The real question is, how do you remember when your bills are due and make sure you pay them on time? Try setting up personalized alerts: sign up for emails or texts from your bank that notify you when your bills are due, your checking account balance is running low, a payment has been posted to your account, your money has been withdrawn from an ATM, or your credit card activity has exceeded a certain limit, among other options. Don’t forget to use the alerts in your toolkit, too; Mint, for instance, offers alerts and reminders when bills are due. On top of using those scheduling instruments, regulate your cash flow in a convenient way by choosing your credit card bill due date wisely — a date in the month you’ll remember.

Make smart adjustments. Some costs are variable, so be sure to review and revise your budget on a regular basis. Even if your income or overall expenditure isn’t changing, consider transferring money from one category to another. “A budget is a working document,” says Daugherty. “Every few weeks or every month, you may want to revisit it so that the amounts still seem relevant and are working effectively.” And when you do, be sure to update your Mint, LearnVest, or other budgeting tools accordingly!

What are your tips for maintaining a post-grad budget? Share in the Comments section below!